master-samsonova.ru Tools

Tools

New Low Stocks To Buy

Stocks Under $10 · SmartKem Inc SMTK. Price: $ Daily change: N/A. Percent change · Outlook Therapeutics Inc OTLK. Price: $ Daily change: N/A · Baiyu. 22 Companies under 52 Week Low ; Alufluoride, , ; Rishabh Instruments, , ; Emmforce Autotech, , ; Sprayking, , Best-performing cheap stocks ; CADL. Candel Therapeutics Inc. % ; APLT. Applied Therapeutics Inc. % ; GTHX. G1 Therapeutics Inc. % ; SERA. Sera. Who is it good for?: Great for investors looking for a relatively low-cost index fund that focuses on technology and growth companies. How to buy: The fund can. 0. (0%) · 2, 52 Weeks Low · 1,%. 3 Year Return. Buy; SIP · Buy Now; Quick SIP. Wishlist; cart; Share. Share via. compare. Once the stocks near their 52 week low, traders start buying the stock. Once the week low is breached, the traders start a new short position. How Is A. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Though these shares are usually very cheap (often trading for pennies on the dollar) they also enjoy much lower levels of oversight. If you're buying your first. Stocks that appear on these pages are stocks that have made or matched a new high or low price for that specific time period during the current trading session. Stocks Under $10 · SmartKem Inc SMTK. Price: $ Daily change: N/A. Percent change · Outlook Therapeutics Inc OTLK. Price: $ Daily change: N/A · Baiyu. 22 Companies under 52 Week Low ; Alufluoride, , ; Rishabh Instruments, , ; Emmforce Autotech, , ; Sprayking, , Best-performing cheap stocks ; CADL. Candel Therapeutics Inc. % ; APLT. Applied Therapeutics Inc. % ; GTHX. G1 Therapeutics Inc. % ; SERA. Sera. Who is it good for?: Great for investors looking for a relatively low-cost index fund that focuses on technology and growth companies. How to buy: The fund can. 0. (0%) · 2, 52 Weeks Low · 1,%. 3 Year Return. Buy; SIP · Buy Now; Quick SIP. Wishlist; cart; Share. Share via. compare. Once the stocks near their 52 week low, traders start buying the stock. Once the week low is breached, the traders start a new short position. How Is A. Many penny stocks are from new companies with a micro market cap of under $ million. You can search here for analysts' top-rated penny stocks. Though these shares are usually very cheap (often trading for pennies on the dollar) they also enjoy much lower levels of oversight. If you're buying your first. Stocks that appear on these pages are stocks that have made or matched a new high or low price for that specific time period during the current trading session.

Buy Now Pay Later (BNPL) Apps · Best Debt Relief. SELECT. All Small new 'rush' hourChip stocks sinkCybertruck reviewDJT lowChase 'glitch'. Though these shares are usually very cheap (often trading for pennies on the dollar) they also enjoy much lower levels of oversight. If you're buying your first. Shares of Meta Platforms (META) are trying to break out past a buy point, but they dropped % Tuesday. They are about 5% below their latest entry. On. New. Controversial. Old. Q&A Don't buy cheap, buy good, solid companies for the long term. What. New Week Highs & Lows ; Champion Homes Inc. Champion Homes Inc. , ; Chimera Investment Corp. % Cum. Redeem. Pfd. Series C. Penny stocks are low-priced shares of small companies, typically traded at INR10 or below. Famous for their high volatility and potential for significant. A penny stock is a unit of common stock that trades with a low share Buy and sell underlying penny stocks. Leverage your exposure – you'll only. Examine United States stocks near 52 week low, a valuable indicator for buy-sell decision making. Active investing relies on real-time market pricing; investors sell their shares when stock prices are high and buy new shares when prices are low. A. The New Highs/Lows page provides access to lists of stocks that have made or matched a new high or low price for a specific time period. Most Active Penny Stocks · STLAPSNYPSNYW · EV maker Polestar appoints Jean-Francois Mady as new CFO · VUZI · Quanta Computer Enters into a Strategic Investment in. Penny Stocks to WatchHot Stocks to Buy NowStocks with Breaking NewsLow Float Penny stock trading is a great way to build your account as a new trader. US stocks at their all-time lows ; AALF · D · USD, −%, K · ; ALTM · D · USD, −%, M · Penny stocks are those shares that trade below $5 per share, and as low as a few pennies per share. Many penny stocks are traded via over-the-counter (OTC). buying shares of relatively new companies. Sometimes value investing is described as investing in great companies at a good price, not simply buying cheap. Best cheap stocks · Comcast (CMCSA) · VICI Properties (VICI) · EQT (EQT) · Tapestry Inc. (TPR) · Fox (FOX, FOXA). Stocks Under $10 · SmartKem Inc SMTK. Price: $ Daily change: N/A. Percent change · Outlook Therapeutics Inc OTLK. Price: $ Daily change: N/A · Baiyu. Looking for the best stocks under $1 to buy in ? MarketBeat has identified 25 low-priced stocks that you should consider for your portfolio. While US markets were closed yesterday global markets moved modestly lower over the last two days. US futures turned lower as we approached the open giving back. low prices, Brookfield bought energy transportation infrastructure on the cheap. That's right, you can buy shares of the New York Stock Exchange on the New.

How To Order Free Items On Amazon

Once enrolled in Vine, Voices may request products from thousands of brands selling in the Amazon store which are shipped to their doorsteps at no cost. They. You do not need to use FBA or be a part of the Seller Fulfilled Prime program to offer free shipping on your products. Free shipping can be offered by. Vine Voices have the unique opportunity to order items free of charge and share their product experiences with Amazon customers to help them make informed. For a label-free, box-free return, initiate the return through Your Orders. If you selected a label-free, box-free return location, you don't have to. Hand-Picked Amazon Deals. To keep this site ad-free, Jungle deals may make a small commission off of select purchases at no extra cost to you via affiliate. Free shipping can be offered by modifying shipping settings in the Amazon Seller Central account, section Shipping settings. For more details, please refer to. Add-on Items are eligible for Free Shipping on qualifying orders. Go to Order with Free Shipping by Amazon for more information. Note: If your cart contains. get a free Amazon Prime membership. For example, you can sign up for a 30 Buying items that are better priced during Black Friday. This isn't the. When you include add-on items with Amazon Prime orders of $25 or more, you also receive Prime shipping benefits, including FREE Two-Day Shipping. Add-on. Once enrolled in Vine, Voices may request products from thousands of brands selling in the Amazon store which are shipped to their doorsteps at no cost. They. You do not need to use FBA or be a part of the Seller Fulfilled Prime program to offer free shipping on your products. Free shipping can be offered by. Vine Voices have the unique opportunity to order items free of charge and share their product experiences with Amazon customers to help them make informed. For a label-free, box-free return, initiate the return through Your Orders. If you selected a label-free, box-free return location, you don't have to. Hand-Picked Amazon Deals. To keep this site ad-free, Jungle deals may make a small commission off of select purchases at no extra cost to you via affiliate. Free shipping can be offered by modifying shipping settings in the Amazon Seller Central account, section Shipping settings. For more details, please refer to. Add-on Items are eligible for Free Shipping on qualifying orders. Go to Order with Free Shipping by Amazon for more information. Note: If your cart contains. get a free Amazon Prime membership. For example, you can sign up for a 30 Buying items that are better priced during Black Friday. This isn't the. When you include add-on items with Amazon Prime orders of $25 or more, you also receive Prime shipping benefits, including FREE Two-Day Shipping. Add-on.

get a free Amazon Prime membership. For example, you can sign up for a 30 Buying items that are better priced during Black Friday. This isn't the. After all, if you're one of the more than million members of Amazon Prime worldwide, you get free shipping plus lots of other Prime benefits. And it's free. Get an instant breakdown of your Amazon sales margin with our free calculator. Learn More Arrow Right. 4. Adopt a review management strategy. Amazon places. 5X Your Amazon Sales with a Free Expert Audit Worth $! Some of the most profitable categories are restricted by Amazon, so make sure you get approval. Try pitching sellers directly. Search for a product you'd like to review for free (or deeply discounted). Find a listing that has few to no reviews. As soon as you purchase any Fulfilled by Amazon item on Amazon, you are eligible for FREE delivery on all Fulfilled by Amazon orders for the next 4 hours After. Whether you're buying gifts, reading reviews, tracking orders, scanning products, or just shopping, the Amazon Shopping app offers more benefits than shopping. Amazon Vine is a program that gives customers free products in exchange for reviews on the site. Here's everything you need to know about the scheme. With FREE Standard Delivery, your order is delivered three to five business days after all of your items are available to be dispatched, including pre-order. Amazon does allow promo code stacking. However, most Amazon coupon codes only allow you to buy a single unit of each product at the discounted rate. To maximize. First, the note under a purchase item: "FREE Shipping on orders over $25 shipped by Amazon" is just a statement they slap on every listed item. It's an ad. You get unlimited FREE Two-Day Shipping on eligible items with Amazon Prime, with no minimum spend. To place an order: Add at least the stated minimum threshold. Prime Members can now get all their groceries delivered from Whole Foods Market and Amazon Fresh with one monthly subscription. Start your free day trial. Whether you're buying gifts, reading reviews, tracking orders, scanning products, or just shopping, the Amazon Shopping app offers more benefits than shopping. The item is eligible for Express Delivery for Amazon Fresh orders. The item may qualify for a free replacement. See master-samsonova.ru Replacement Policy. Amazon. How to claim: Add all products described in the promotion to your Shopping Cart in one of two ways: Using the Add both to Cart button near the promotion. All orders of at least $25 of any combination eligible items qualify for free standard shipping. In some cases, there are additional specific options or. Items ship with orders that contain $35 of items shipped by Amazon. Some items at Amazon qualify for free shipping, but sometimes your order will fall short. Place orders before the Same-Day Delivery order cutoff time. · Select Same-Day at checkout and shipping to a residential address. · Select an eligible destination. Place orders before the Same-Day Delivery order cutoff time. · Select Same-Day at checkout and shipping to a residential address. · Select an eligible destination.

M & A Capital

Our M&A and Advisory services combine significant transaction experience with deep sector-specific knowledge and extensive relationships with buyers, investors. At M&A Capital we have a diversified portfolio of investments that include banking, real estate, insurance, services, among others. We participate in direct. In M&A investment banking, bankers advise companies and execute transactions where the companies sell themselves to buyers, acquire smaller companies (targets). We can help throughout your business journey. From set-up and early-stage funding to larger investments like private equity and M&A, we act on buy-side and. Uncover the latest trends and get exclusive insights in the Q2 edition of the M&A and Capital Markets newsletter. A boutique real estate advisory firm. M&A Realty Capital was founded with the goal of connecting global investors. J.P. Morgan advises corporations and institutions on mergers and acquisitions, meeting the most complex strategic needs. Explore bespoke M&A solutions. The Charter team shares their insights on quarterly M&A trends in targeted industries and takes readers on a deep dive into a variety of specific investment. Deep global M&A transaction data allows you to analyze deals quickly, conduct a thorough due diligence, and capitalize on opportunities. Our M&A and Advisory services combine significant transaction experience with deep sector-specific knowledge and extensive relationships with buyers, investors. At M&A Capital we have a diversified portfolio of investments that include banking, real estate, insurance, services, among others. We participate in direct. In M&A investment banking, bankers advise companies and execute transactions where the companies sell themselves to buyers, acquire smaller companies (targets). We can help throughout your business journey. From set-up and early-stage funding to larger investments like private equity and M&A, we act on buy-side and. Uncover the latest trends and get exclusive insights in the Q2 edition of the M&A and Capital Markets newsletter. A boutique real estate advisory firm. M&A Realty Capital was founded with the goal of connecting global investors. J.P. Morgan advises corporations and institutions on mergers and acquisitions, meeting the most complex strategic needs. Explore bespoke M&A solutions. The Charter team shares their insights on quarterly M&A trends in targeted industries and takes readers on a deep dive into a variety of specific investment. Deep global M&A transaction data allows you to analyze deals quickly, conduct a thorough due diligence, and capitalize on opportunities.

SC&H Capital specializes in guiding founder- and family-owned businesses through successful M&A transactions. Capital Markets vs. Investment Banking: Skill Sets. The main difference here is that ECM and DCM are far less modeling-intensive, so you'll spend more time in. M&A Capital, LLC is an investment banking firm advising businesses and their shareholders on the formulation and implementation of financial strategies that. M&A Capital Partners provides M&A brokerage services for small and medium-sized companies. About us. M&A Capital Partners provides M&A brokerage services for small and medium-sized companies. About us. M&A Capital Partners provides merger and acquisition advisory services, including due diligence, third-party allocation and finance operations support. A trusted advisor to business owners of leading middle market companies on complex corporate finance, mergers and acquisitions and strategic challenges. We are a market leader in M&A transactions with a team experienced at advising boards of directors, commercial and legal teams, in both friendly and hostile. Chertoff Capital advises leading businesses in the National Security, Cybersecurity and Defense Technology markets through every stage of the M&A process. J.P. Morgan advises corporations and institutions on mergers and acquisitions, meeting the most complex strategic needs. Explore bespoke M&A solutions. The simple definition of net working capital is current assets minus current liabilities. Generally, current assets and current liabilities are expected to. Investment management M&A activity is likely to increase this year, as organizations look to build scaled platforms with in-demand asset class capabilities like. M&A South is the premier networking event in the Southeast for participants in all facets of corporate growth and Middle Market deal making. Among buyers, 44% say that financing and capital markets will aid their acquisition strategy in , indicating confidence in the interest rate environment. ACT Capital Advisors is a premier M&A advisory firm. Our unique Auction Process helps you unlock the full value of your business and get the best terms. Commercial Real Estate Financing * Hospitality * Mixed-Use * New Construction * MultiFamily * Debt Restructure * Modular Construction and Design * · M&A. Our AI-enabled M&A technology solutions provide actionable insights and facilitate better decision-making throughout the entire transaction lifecycle. Citizens Capital Markets & Advisory is a fast-growing investment bank offering comprehensive services in M&A advisory, debt and equity capital markets. Capital One's Mergers and Acquisitions team offers a wide variety of advisory services, including sell-side, buy-side, divestiture, recapitalizations. Ed Zimmerman · Partner Chair and Co-Founder, Emerging Companies & Venture Capital (fka, The Tech Group).

Donating Plasma For Money How Much

I come a few times a year for regular blood donations and I usually make an appointment so there's never much of a wait. So much more convenient and comfortable. The plasma you donate will be used in medicinal products that treat severe and rare diseases. Donation is safe and you'll be compensated: learn more! Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Is donating plasma worth it? In this video we compare three of MONEY: ▻Receive A Free Stock Up To $, Guaranteed: https://join. Giving = Living. Save lives by giving plasma. For a donation center close to you, use the location finder. B Positive donors are financially compensated for the time they spend donating blood plasma. New (first-time) Donors can earn over $* in their first month. New Donors Get up to $*! *Based on center location. Terms & conditions apply. I come a few times a year for regular blood donations and I usually make an appointment so there's never much of a wait. So much more convenient and comfortable. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. I come a few times a year for regular blood donations and I usually make an appointment so there's never much of a wait. So much more convenient and comfortable. The plasma you donate will be used in medicinal products that treat severe and rare diseases. Donation is safe and you'll be compensated: learn more! Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. Is donating plasma worth it? In this video we compare three of MONEY: ▻Receive A Free Stock Up To $, Guaranteed: https://join. Giving = Living. Save lives by giving plasma. For a donation center close to you, use the location finder. B Positive donors are financially compensated for the time they spend donating blood plasma. New (first-time) Donors can earn over $* in their first month. New Donors Get up to $*! *Based on center location. Terms & conditions apply. I come a few times a year for regular blood donations and I usually make an appointment so there's never much of a wait. So much more convenient and comfortable. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments.

Plasma donation changes lives, one donor at a time. · New Plasma Donors Can Earn Over $ During the First 35 Days! · New Plasma Donors Can Earn Over $ During. A plasma donation allows you to give a specific part of your blood and help patients with life-threatening blood loss. Donate plasma today! Visit one of our local centers and earn money each time you donate. Sign up today to become a plasma donor and schedule your next donation appointment. Hemarus Plasma donation center is your local plasma donation center located in Lauderhill Mall, Lauderhill & Northside Shopping Center in Miami. $20 to $50 per donation. Payment is for time/inconvenience, pain. Unit of plasma costs hospitals $+. Uses: hemophiliacs, albumin for burns. Parachute is the easiest way to earn extra money by donating plasma. Earn up to $ for your first two donations. Typically you can earn $$75 each time you donate plasma. Since plasma is in such high demand, many companies have started offering extra incentives for new. The center will help you complete a health questionnaire and conduct a quick physical to determine your eligibility. After each successful donation, you will be. The need for plasma and plasma donors is more urgent than ever before. Visit master-samsonova.ru to learn more and to find a donation center near you. The survey asks many of the same questions as the IRSFFA survey, including questions about plasma donation, that allow us to study a broader sample during the. Help save lives with donating plasma and get paid too! This page details how much you get paid and how often. Read further. The NYBC Donor Advantage Program rewards frequent blood, platelet and plasma donors. Earn points with each donation and redeem them for gifts or gift cards. Make your blood donation go further by donating blood plasma. A single AB Elite donation can provide up to three units of plasma to patients in need. You'll typically be paid between $20 and $60 for each donation. Depending on how often you donate, you can earn as much as $ per month donating plasma. How much do you pay for plasma and platelet donations? The plasma donation centers in NYC are dominated by New York Blood Center (NYBC), which doesn't pay very well. Most donors can expect to earn around $$ Donating plasma takes time and commitment. To help ensure a safe and adequate supply of plasma, donors are provided with a modest stipend to recognize the. Grifols Plasma has united some of the best plasma donation centers in the Plasma is the key component in many lifesaving medicines. plasma. Deferrals disqualify you from donating plasma. There are many reasons temporary or permanent deferrals can happen. Learn more on how to avoid plasma deferrals. What is plasma and why is it important? Plasma serves many important functions in our body. Learn more about plasma and its importance.

Roth Ira From Employer

Learn more about both Roth IRAs and Roth (k)s, including how they work, their income limitations, and why you should consider contributing to them. Neither Roth IRAs nor traditional IRAs include employer matching provisions; the account holder fully funds the account. How do (k), Roth IRA, and. Key Takeaways · You can contribute to both a Roth individual retirement account (Roth IRA) and an employer-sponsored retirement plan, subject to income limits. Roth accounts like the Roth (k) are a more recent addition to employer-sponsored plans. Similar to the Roth IRA, contributions are made with after-tax. Secure Choice participants are enrolled in a default target date Roth IRA However, unlike a traditional retirement plan, employers are not considered. With employer-plan Roth contributions, there are no salary limits. Employer plan contribution limits are also much higher than IRA limits, allowing you to save. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. Roth is just a type of tax treatment (and always, by definition, are paid by the individual: employers cannot contribute to a Roth, ever). So. No possibility of employer match: Unlike a Roth (k), a Roth IRA is a personal account that doesn't leave the possibility of an employer match. Learn more about both Roth IRAs and Roth (k)s, including how they work, their income limitations, and why you should consider contributing to them. Neither Roth IRAs nor traditional IRAs include employer matching provisions; the account holder fully funds the account. How do (k), Roth IRA, and. Key Takeaways · You can contribute to both a Roth individual retirement account (Roth IRA) and an employer-sponsored retirement plan, subject to income limits. Roth accounts like the Roth (k) are a more recent addition to employer-sponsored plans. Similar to the Roth IRA, contributions are made with after-tax. Secure Choice participants are enrolled in a default target date Roth IRA However, unlike a traditional retirement plan, employers are not considered. With employer-plan Roth contributions, there are no salary limits. Employer plan contribution limits are also much higher than IRA limits, allowing you to save. Yes, you can have a Roth IRA and a (k) if you're eligible for your employer's (k) plan and you qualify to contribute to a Roth IRA. Roth is just a type of tax treatment (and always, by definition, are paid by the individual: employers cannot contribute to a Roth, ever). So. No possibility of employer match: Unlike a Roth (k), a Roth IRA is a personal account that doesn't leave the possibility of an employer match.

Saving through an IRA will not be appropriate for all individuals. Employer facilitation of IL Secure Choice should not be considered an endorsement or. Benefits of a Roth (k) · Retirement account with tax-free growth potential · Employee pays taxes now while in an assumed lower tax bracket than during. An employer-sponsored Roth (k) plan is similar to a traditional plan with one major exception. Contributions by employees are not tax-deferred but are made. For , the annual contribution limit for SIMPLE IRAs is $16,, up from $15, in Workers age 50 or older can make additional catch-up contributions. Under a Payroll Deduction IRA, employees establish a Traditional or Roth IRA with a financial institution and authorize a payroll deduction amount for it. A Roth Individual Retirement Account (IRA) is funded with money you've already paid taxes on. Growth on that money, as well as your future withdrawals, are then. Your employee opens either a traditional or a Roth IRA account (based on their eligibility and personal choice) with the financial institution and authorizes. Employer registration deadlines. State law now requires every Illinois employer However, not everyone is eligible to contribute to a Roth IRA and a. DCP Roth does not. Roth DCP has higher maximum contribution limits than a. Roth IRA ($22, vs $6, in ). How is a Roth deferral percentage calculated. A Roth (k) is an employer-sponsored after tax retirement account that has features of both a Roth IRA and a (k). Limits on Roth IRAs The employer can increase an employee's wages, but it can't force the employee to set that money aside in a Roth IRA or any other. Yes. If you're employed you can contribute to a roth IRA. However there is an income limit for eligibility. You need to check irs website or just google what. An IRA is an individual retirement account that can be used to complement an employer-sponsored account. Learn about MissionSquare Roth & traditional IRAs. Roth accounts like the Roth (k) are a more recent addition to employer-sponsored plans. Similar to the Roth IRA, contributions are made with after-tax. What's the difference between making contributions to a Roth IRA and Roth contributions to a Are employer contributions on Roth contributions tax-free? Saving through an IRA may not be appropriate for all individuals. Employer facilitation of CalSavers should not be considered an endorsement or recommendation. Traditional IRA contributions are often tax-deductible. However, if you have an employer-sponsored retirement plan at work, such as a (k), your tax deduction. A low-cost, tax-deductible plan allowing both employees and employers to contribute. Similar to a (k), but with less work. If your employer doesn't offer a plan, then an IRA can be a good start to your retirement savings and another opportunity for your earnings to grow tax-free.

Does 401k Limit Include Employer Match

Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. Where can I find my IRS Contribution Limits? Here at pensionscom, FMI Retirement Services Long Island New York. Employer match does however count toward the overall limit which is $61, for The employer's match does not count towards your contribution limit. There are limits for combined contributions, but that rarely comes into. The maximum contribution amount, on the other hand, refers to the total amount of funds both the employee and employer can contribute during the year. Total. The overall (k) limits for employee and employer contributions is $69,, or $76, for workers 50 and up. Motley Fool Issues Rare “All In” Buy Alert. There are two different annual limits on k contributions. The elective deferrals limit, and the annual additions limit. Your employer match counts toward. If you increase your contribution to 10%, you will contribute $10, Your employer's 50% match is limited to the first 6% of your salary then limits your. Note that any employer match doesn't count toward an individual's (k) annual contribution limit ($23, in or $30, for those 50 and up). However. Matching (k) contributions are the additional contributions made by employers, on top of the contributions made by employees. Where can I find my IRS Contribution Limits? Here at pensionscom, FMI Retirement Services Long Island New York. Employer match does however count toward the overall limit which is $61, for The employer's match does not count towards your contribution limit. There are limits for combined contributions, but that rarely comes into. The maximum contribution amount, on the other hand, refers to the total amount of funds both the employee and employer can contribute during the year. Total. The overall (k) limits for employee and employer contributions is $69,, or $76, for workers 50 and up. Motley Fool Issues Rare “All In” Buy Alert. There are two different annual limits on k contributions. The elective deferrals limit, and the annual additions limit. Your employer match counts toward. If you increase your contribution to 10%, you will contribute $10, Your employer's 50% match is limited to the first 6% of your salary then limits your. Note that any employer match doesn't count toward an individual's (k) annual contribution limit ($23, in or $30, for those 50 and up). However.

The total contribution limit for both employee and employer contributions to (k) defined contribution plans under section (c)(1)(A) increased from $66, Combined employee and employer contributions cannot exceed $69, or $76, for those who are age 50 or older. If you're one of millions of Americans without. In the United States, a (k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection (k) of. Maximum employer and employee contributions, $69, Maximum including catch-up contributions, $76, Highly compensated employee threshold, $, The (k) contribution limit for is $22, for employee contributions and $66, for combined employee and employer contributions. If you're age 50 or. Using a matching contribution formula will provide employer contributions only to employees who contribute to the (k) plan. If you choose to make nonelective. Also note employer contributions do not count toward the IRS annual contribution limit. Matching contributions can also be subject to a vesting schedule. See. Employers that offer matching contributions are held to a limit as well. The combined amount of employee and employer contributions cannot be more than % of. Combined employee and employer contributions cannot exceed $69, or $76, for those who are age 50 or older. If you're one of millions of Americans without. Employers' (k) match amounts vary widely. However, all contribution limits and withdrawal regulations must comply with the standards of the Employee. 4 In , the total combined limit, including elective employee deferrals, after-tax contributions, and employer matching funds, is $69, (or $76, if you'. This limit includes such contributions to all (k), (b), SIMPLE and SARSEP plans at all employers during your taxable year. Contributions to (b). The employer contribution does not affect your (k) contribution limit. However, the IRS places a cap on the total employee and employer contributions made. The maximum contribution amount, on the other hand, refers to the total amount of funds both the employee and employer can contribute during the year. Total. Where can I find my IRS Contribution Limits? Here at pensionscom, FMI Retirement Services Long Island New York. A (k) employer match is money your company contributes to your (k) account. If your employer offers (k) matching, it means they will match the. Max out your contributions. · Once you turn 50, add another $7, to that limit annually while you continue to work. · If your employer offers to match your. employer available to them had they contributed up to the 6% limit. include some kind of employer match for employee contributions. Employer. For , the elective deferral increased to $23,, or $30, if age 50 or older. Type 2. Profit sharing also known as Employer Contribution. This amount. The employer does not include the Employer Contributions as wages in Box 1 • Employer Contributions are counted against the Maximum Contribution Limit of.

70k Down Payment

As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. These costs may be significant and may affect your affordability, debt-to-income ratio or monthly payment. How much house can I afford? To know how much house. Free down payment calculator to find the amount of upfront cash needed, down payment percentage, or an affordable home price based on 3 potential. How to calculate land payments. The loan calculator can give you an approximate monthly payment for a land loan. It only takes a minute to fill in information. A temporary buydown can reduce your monthly mortgage payments. Plug in your numbers and select your options to calculate what kind of cash it'll take. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Monthly Income · Monthly Payments · Loan Info. So how much should you put down on a house? Use NerdWallet's free down payment calculator to find an amount that fits your budget. Is PMI required for the above down-payment amount? Your monthly PMI payment: Loan Type, % Down, Downpayment, Loan Amount. This down payment calculator will help you estimate how large of a down payment you need to buy a house. Explore minimum down payments by loan type. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. These costs may be significant and may affect your affordability, debt-to-income ratio or monthly payment. How much house can I afford? To know how much house. Free down payment calculator to find the amount of upfront cash needed, down payment percentage, or an affordable home price based on 3 potential. How to calculate land payments. The loan calculator can give you an approximate monthly payment for a land loan. It only takes a minute to fill in information. A temporary buydown can reduce your monthly mortgage payments. Plug in your numbers and select your options to calculate what kind of cash it'll take. You may qualify for a loan amount ranging from $, (conservative) to $, (aggressive) · Monthly Income · Monthly Payments · Loan Info. So how much should you put down on a house? Use NerdWallet's free down payment calculator to find an amount that fits your budget. Is PMI required for the above down-payment amount? Your monthly PMI payment: Loan Type, % Down, Downpayment, Loan Amount. This down payment calculator will help you estimate how large of a down payment you need to buy a house. Explore minimum down payments by loan type.

Most home loans require at least 3% of the price of the home as a down payment. Some loans, like VA loans and some USDA loans allow zero down. Although it's a. Calculate the monthly payment of a mortgage and create a loan amortization schedule. Enter your loan details and click calculate. Use SmartAsset's free Connecticut mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and. Calculate an estimated monthly payment for a new or pre-owned Porsche with our payment calculator tool. Down payment chart for a 70, property ; 25% down for a $70, home, $17,, $52, ; 30% down for a $70, home, $21,, $49, ; 35% down for a $70, Hundred twenty K income, no debts, and 70 K to put down. Thoughts? I have some. Let's get into it. As always, we start by taking that hundred twenty K. Down paymentSelect a down payment. 3%, %, 4%, %, 5%, 10%, 15%, 20%, 25%, 30%. Down payment. Money paid toward the purchase of a home, typically ranging. How to Get a Mortgage ; 70,, 5% Down, 3,, 66, ; 70,, 10% Down, 7,, 63, Down payment amount. Monthly payment amount. Interest rate. Show payment schedule. Calculator Results. It will take 68 payments to pay off your loan. Calculator. Loan Info. Purchase price? Must be between $1 and $1,,, $ %. Purchase price. Down payment ($50K)? Must be between % and %. $ %. Down. What's a typical down payment on a $70, Home? A down payment of 20% is standard for a 30 year mortgage but it can vary based on the lender. See the chart. The first steps in buying a house are ensuring you can afford to pay at least 5% of the purchase price of the home as a down payment and determining your budget. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium (MIP) and annual. Use SmartAsset's free Florida mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan. For a 70, house, this would be $14, However, some loans offer down payments as low as 3% to buyers with excellent credit, high income, and large assets. Find Out Your Max Ideal Payment, Then Call Us! ; Loan Amount: $, % ; Down Payment: $50, (%). % ; Total Interest Paid: $, Most mortgage providers have minimum down payment requirements, which can be as low as % for FHA loans for example. If your down payment is not equal to 20%. The Down Payment Assistance Program provides assistance to qualified first time homebuyers for down payment and closing costs associated with purchasing a home. FHA loans: with a % down payment; with a 10% down payment; VA loans: ; USDA loans: (some lenders allow a lower score). As with DTI, lenders.

Good Shares To Invest In Now

Best stock for beginners · Broadcom (AVGO) · JPMorgan Chase (JPM) · UnitedHealth (UNH) · Comcast (CMCSA) · Bristol-Myers Squibb Co. (BMY). The top 10 Small Caps over 10 years · 1. Northern Star Resources (NST) · 2. Pilbara Minerals (PLS) · 3. Nick Scali (NCK) + · 4. Data3 (DTL) · 5. Macquarie. Uber Technologies (UBER), , Strong Buy ; Broadcom (AVGO), , Strong Buy ; Micron Technologies (MU), , Strong Buy ; ServiceNow (NOW), , Strong Buy. U.S. new home sales surged a hefty % to K in July, perhaps giving fuel to RDFN shares which jumped over 20% today and are now at their highest level. Value of deals - most sold shares ; 7, VUSA, Vanguard Funds Plc ; 8, IAG, International Consolidated Airlines Group SA ; 9, 3NVD, Leverage Shares plc ; 10, RR. Very good app. I like just about everything about it - ESPECIALLY for one thing and EXCEPT for one thing. I especially like the fact you can. Many top stocks deliver solid returns year after year. Below are the best-performing stocks in the S&P year to date. Stock Movers ; RILYG · B. Riley Financial, Inc. - % Senior Notes due , $, % ; TZA · Direxion Small Cap Bear 3X Shares, $, %. Stocks to Buy Today · 1. CGPOWER: ON THE VERGE OF BREAKOUT · 2. CRAFTMAN: VOLUME SPURT · 3. AEROFLEX: RISING VOLUME · 4. WELENT: HIGHER TOP HIGHER BOTTOM FORMATION. Best stock for beginners · Broadcom (AVGO) · JPMorgan Chase (JPM) · UnitedHealth (UNH) · Comcast (CMCSA) · Bristol-Myers Squibb Co. (BMY). The top 10 Small Caps over 10 years · 1. Northern Star Resources (NST) · 2. Pilbara Minerals (PLS) · 3. Nick Scali (NCK) + · 4. Data3 (DTL) · 5. Macquarie. Uber Technologies (UBER), , Strong Buy ; Broadcom (AVGO), , Strong Buy ; Micron Technologies (MU), , Strong Buy ; ServiceNow (NOW), , Strong Buy. U.S. new home sales surged a hefty % to K in July, perhaps giving fuel to RDFN shares which jumped over 20% today and are now at their highest level. Value of deals - most sold shares ; 7, VUSA, Vanguard Funds Plc ; 8, IAG, International Consolidated Airlines Group SA ; 9, 3NVD, Leverage Shares plc ; 10, RR. Very good app. I like just about everything about it - ESPECIALLY for one thing and EXCEPT for one thing. I especially like the fact you can. Many top stocks deliver solid returns year after year. Below are the best-performing stocks in the S&P year to date. Stock Movers ; RILYG · B. Riley Financial, Inc. - % Senior Notes due , $, % ; TZA · Direxion Small Cap Bear 3X Shares, $, %. Stocks to Buy Today · 1. CGPOWER: ON THE VERGE OF BREAKOUT · 2. CRAFTMAN: VOLUME SPURT · 3. AEROFLEX: RISING VOLUME · 4. WELENT: HIGHER TOP HIGHER BOTTOM FORMATION.

Best Coffee Stocks To Invest In Right Now · When it comes to investing, keying buy equity stakes in that company which are known as shares of stock. Buy APL Apollo Tubes, target price Rs Motilal Oswal · Buy LTIMindtree, target price Rs Motilal Oswal · Buy Infosys, target price Rs Motilal. Stock Investing Topics. Dividends. View All · 10 Best Dividend Aristocrats to Buy Now. Susan Dziubinski Aug 20, · Alphabet, Meta, and Salesforce Released. good enough? Read full story · Here's the case for Amazon as a value stock to buy now · Four REIT stocks pass a strict quality screen, with dividend yields up. 7 Great Stocks To Buy and Hold · #1) Enterprise Products Partners (EPD) · #2) Brookfield Corporation (BN) · #3) MicroStrategy (MSTR) · #4) HDFC Bank (HDB) · #5). Now the question is: Will this upward trajectory continue into ? And how can the average person get the most out of their investments next year? Here's what. Investing involves risk. There is always the potential of losing money when you invest in securities. Past performance does not guarantee future results. Asset. The meme stock scheduled posts will now run weekly and post Saturday Questions like “Thoughts on _____?” or “Is ___ a good investment?” will be. Trending Stocks ; Barclays. 23/08 |BARC. ++ ; EasyJet. 23/08 |EZJ. ++ ; Rio Tinto PLC. 23/08 |RIO. 4, ; Neo Energy. buy HDFC Bank | 1, Buy HDFC Bank; target of Rs 1, ICICI Securities · buy Tejas Networks | 1, Buy Tejas Networks; target of Rs Emkay. Stocks ; NVDA NVIDIA Corporation. ; INND InnerScope Hearing Technologies, Inc. ; TSLA Tesla, Inc. ; INTC Intel Corporation. ; LCID Lucid. Horton Is the Home Builder Stock to Buy Now · Travel. Aug. 9, p.m. ET This 'Stodgy' Industrial Just Keeps Making Money. It's a Good Time to Buy the. List of US Stocks to Buy in · 1) Apple Inc. (AAPL) · 2) Microsoft Corporation (MSFT). Microsoft is a multinational technology company established in and. I'm looking at META, AVGO, TSLA and NFLX. Which stock is best to invest now and why? Thanks in advance. Buy rated by analysts ; Interglobe Aviation Ltd. ₹ · % ; Solar Industries India Ltd. ₹ · % ; Bharti Hexacom Ltd. ₹ · %. Value of deals - most sold shares ; 7, VUSA, Vanguard Funds Plc ; 8, IAG, International Consolidated Airlines Group SA ; 9, 3NVD, Leverage Shares plc ; 10, RR. They also look for a few penny stocks to buy now that offer both variety and diversity. Everyone wants to know how to find the best penny stocks, but those. Pick the best stocks to buy and optimize your portfolio with the power of our AI. Get unbiased and unique insights, and make smart data-driven investment. now a good time to buy a house or should I wait? If you're thinking about investing, using a stocks and shares ISA may be a good place to start. Top Penny Stock Gainers ; REVB. Revelation Biosciences ; VHAI. Vocodia Holdings Corp. ; SDIG. Stronghold Digital Mining ; VEV. Vicinity Motor.

How To Calculate Amt Credit

To determine whether they owe federal AMT, taxpayers must generally calculate their federal AMT income by adding exclusion and deferral items to their regular. The AMT rules also disallow certain deductions and credits that are allowed under the regular federal income tax system. And the maximum AMT rate is only 28%. The AMT is calculated based on the difference between the fair market value of the shares on the date that you exercised the shares and the exercise price. The. Alternative minimum tax (AMT) calculator with deductions and estimates your tax after exercising Incentive Stock Options (ISO) for and You will only. The Alternative Minimum Tax (AMT) Net Operating Loss (NOL), line 24, is calculated by recalculating line 25 without regard to an NOL. If you exercised ISOs in or , an AMT calculator helps estimate the alternative minimum tax you may owe. Download the AMT calculator to get started. The AMT payment of $, plus the final tax payment on sale of $0 equals the cumulative taxes paid of $, In calculating alternative minimum taxable income (AMTI), a taxpayer starts with regular tax adjusted gross income and adds or subtracts from it any AMT. Click the calculator icon next to the $0 in the AMT row. This will bring up the line-by-line calculation of Form , which is used to calculate AMT. Subtract. To determine whether they owe federal AMT, taxpayers must generally calculate their federal AMT income by adding exclusion and deferral items to their regular. The AMT rules also disallow certain deductions and credits that are allowed under the regular federal income tax system. And the maximum AMT rate is only 28%. The AMT is calculated based on the difference between the fair market value of the shares on the date that you exercised the shares and the exercise price. The. Alternative minimum tax (AMT) calculator with deductions and estimates your tax after exercising Incentive Stock Options (ISO) for and You will only. The Alternative Minimum Tax (AMT) Net Operating Loss (NOL), line 24, is calculated by recalculating line 25 without regard to an NOL. If you exercised ISOs in or , an AMT calculator helps estimate the alternative minimum tax you may owe. Download the AMT calculator to get started. The AMT payment of $, plus the final tax payment on sale of $0 equals the cumulative taxes paid of $, In calculating alternative minimum taxable income (AMTI), a taxpayer starts with regular tax adjusted gross income and adds or subtracts from it any AMT. Click the calculator icon next to the $0 in the AMT row. This will bring up the line-by-line calculation of Form , which is used to calculate AMT. Subtract.

The calculation of the tentative alternative minimum tax uses a broader measure of taxable income and a flat rate lower than the top marginal rate levied under. For these reasons, the only true way to calculate whether the AMT tax will apply in any particular year is to the AMT liability – the AMT credit does NOT off-. An alternative minimum taxable income (AMTI) is calculated by taking the ordinary income and adding disallowed items and credits such as state and local tax. The calculation includes an AMT exemption and an AMT phaseout range at certain income levels. Generally speaking, when your income for figuring the AMT enters. Deferral items can create a minimum tax credit (also called the AMT credit). To calculate the minimum tax credit; To calculate the amount you can carry. How is the tentative minimum tax calculated? · Starting with taxable income for regular tax purposes, · Eliminating or reducing certain exclusions, deductions. For taxpayers, this means they need to calculate their income twice: once under the regular tax rules and a second time under AMT. After running this. To determine whether they owe federal AMT, taxpayers must generally calculate their federal AMT income by adding exclusion and deferral items to their regular. An alternative minimum tax (AMT) places a floor on the percentage of taxes that a filer must pay to the government, no matter how many deductions or credits. Regular tax calculation – AMT calculation = amount of MTC you can use to reduce taxes. (Yes, this would be a negative number, and therefore your “credit.”) So. repeal of the federal corporate AMT or to the changes to the NOL and AMT Credit provisions. California taxpayers continue to compute AMT, NOLs, and AMT Credit. Try our simple Alternative Minimum Tax (AMT) Calculator! We just need 5 inputs to provide an estimated AMT impact for your ISO exercise. When you get to the screen that asks if you paid AMT in the past and had timing items, answer Yes and follow our onscreen instructions to calculate this credit. compute alternative minimum taxable income (AMTI), · subtract the appropriate AMT exemption amount from AMTI, · apply the AMT tax rate(s), · compute tentative. You then multiply the net amount of AMTI by your AMT rate (26% or 28%) to obtain the amount of AMT you owe. AMT. You calculate your regular taxable income. · You complete AMT Form which applies any adjustments or preferences to determine alternative minimum taxable. The correct way to solve this problem is: $, ( AMT limit for 26% tax rate) X 26% = $49, ($, - $,) X 28% = $33, For every $1 beyond the phase out amount, the exemption amount is reduced by $ For example, a single person who has AMTI of $, will only have 72, AMT Amount = A * (B – C) – D · Subtract the deductions from the total income ($, – $, = $,) · Assuming no other tax credits, the tax payable. The Alternative Minimum Tax (AMT) is a separate tax system that requires some taxpayers to calculate their tax liability twice.

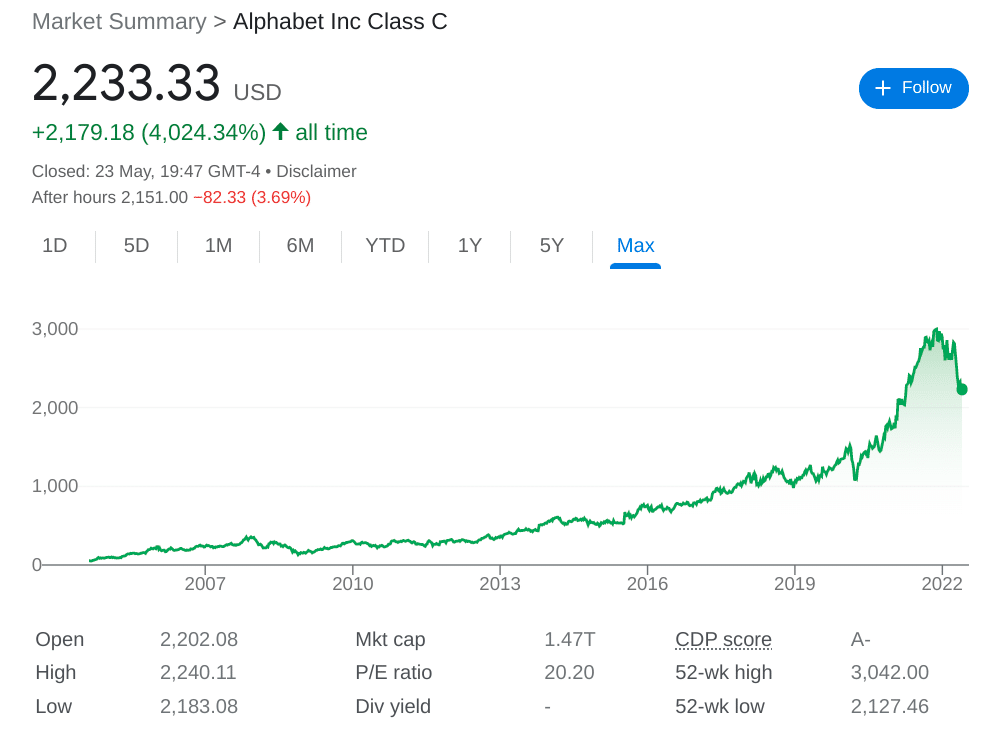

Alphabet Stock Futures

Class C future price: according to them, GOOG price has a max estimate of USD and a min estimate of USD. Based on short-term price targets offered by 42 analysts, the average price target for Alphabet comes to $ The forecasts range from a low of $ to a. View Alphabet Inc. Class C GOOG stock quote prices, financial information, real-time forecasts, and company news from CNN. Class A stock trades on the NASDAQ stock exchange under the ticker symbol GOOGL. Past profits do not guarantee future profits. Use the training services of. Spread betting on Alphabet stock lets you bet an amount of money per point of movement in the share price. This movement can be up or down, meaning you can go. Alphabet Inc. Cl C historical stock charts and Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. View Alphabet Inc. Class A GOOGL stock quote prices, financial information, real-time forecasts, and company news from CNN. Alphabet Inc Class A. $ GOOGL % ; master-samsonova.ru Inc. $ AMZN % ; Apple Inc. $ AAPL %. Discover real-time Alphabet Inc. Class A Common Stock (GOOGL) stock prices, quotes, historical data, news, and Insights for informed trading and investment. Class C future price: according to them, GOOG price has a max estimate of USD and a min estimate of USD. Based on short-term price targets offered by 42 analysts, the average price target for Alphabet comes to $ The forecasts range from a low of $ to a. View Alphabet Inc. Class C GOOG stock quote prices, financial information, real-time forecasts, and company news from CNN. Class A stock trades on the NASDAQ stock exchange under the ticker symbol GOOGL. Past profits do not guarantee future profits. Use the training services of. Spread betting on Alphabet stock lets you bet an amount of money per point of movement in the share price. This movement can be up or down, meaning you can go. Alphabet Inc. Cl C historical stock charts and Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. View Alphabet Inc. Class A GOOGL stock quote prices, financial information, real-time forecasts, and company news from CNN. Alphabet Inc Class A. $ GOOGL % ; master-samsonova.ru Inc. $ AMZN % ; Apple Inc. $ AAPL %. Discover real-time Alphabet Inc. Class A Common Stock (GOOGL) stock prices, quotes, historical data, news, and Insights for informed trading and investment.

Alphabet Inc Class C (GOOG) ; 52 wk Range: ; Volume: 18,, ; Average Vol. (3m): 17,, ; 1-Year Change: % ; Fair Value. Unlock. On Wednesday 09/11/ the closing price of the Alphabet A (ex Google) share was $ on BTT. Compared to the opening price on Wednesday 09/11/ on BTT. View Alphabet-A (GOOGL) stock price, news, historical charts, analyst ratings futures, or other financial products. All information and data on the. Stocks: Real-time U.S. stock quotes reflect trades Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Key Stats · Market CapT · Shares OutB · 10 Day Average VolumeM · Dividend · Dividend Yield% · Beta · YTD % Change Based on 11 Wall Street analysts offering 12 month price targets for Alphabet Class C in the last 3 months. The average price target is $ with a high. What Is the Alphabet A (GOOGL) Stock Price Today? The Alphabet A stock price today is ; What Stock Exchange Does Alphabet A Trade On? Alphabet A is listed. Futures · Overview; Introduction to Please enter a valid Stock, ETF, Mutual Fund, or index symbol. Recent research: Alphabet Inc. Alphabet Inc GOOGL:NASDAQ. These private companies could be the 'magnificent seven' of the future. MarketWatch Sep 11, pm. EU Top Court Upholds $ Billion Fine Against Google. Alphabet Inc. Cl C ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Find the latest Alphabet Inc. (GOOG) stock quote, history, news and other S&P Futures. 5, + (+%) · Dow Futures. 40, + (+ Get the latest updates on Alphabet Inc. Class A Common Stock (GOOGL) pre market trades, share volumes, and more. Make informed investments with Nasdaq. Stock analysis for Alphabet Inc (GOOGL:NASDAQ GS) including stock price, stock chart, company news, key statistics, fundamentals and company profile. The Alphabet Inc. stock prediction for is currently $ , assuming that Alphabet Inc. shares will continue growing at the average yearly rate as they. Alphabet Inc. Cl A ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Alphabet Inc ; Previous Close: ; Volume: 18, ; 3 Month Average Trading Volume: ; Shares Out (Mil): 12, ; Market Cap: 1,, Alphabet Inc. stocks trade on the NASDAQ Stock Exchange through two classes of shares, one of which is GOOG. GOOG shares give its stockholders ownership of the. Alphabet's stock may look cheap, but investors may want to think twice S&P Futures. 5, + (+%) · Dow Futures. 40, + (+ In , Alphabet's share price stood as one of the eight highest stock prices in history. Futures & Options · IPO · Mutual Funds · NFO · Credit · Bill.

1 2 3 4 5 6